Cold Storage Explained: Why Hardware Wallets Matter

Understanding the critical differences between hot and cold wallets, and why self-custody through hardware solutions is the gold standard for digital asset security in 2026.

What is Cold Storage?

Cold storage refers to cryptocurrency storage methods that keep your private keys completely offline and physically isolated from internet-connected devices.

The Offline Advantage

Cold storage wallets never connect to the internet, making them immune to remote attacks that plague online wallets. Your private keys remain on a dedicated hardware device with a secure element chip, protected from malware, phishing, and hacking attempts that target internet-connected systems.

This air-gapped architecture creates a physical barrier between your crypto assets and potential attackers. Even if your computer is compromised, your funds remain secure because the signing keys never leave the cold storage device.

Cold Storage vs Hot Storage: Key Technical Difference

| Cold Storage | Private keys stored on offline hardware device with secure element chip. Transaction signing occurs on isolated device, then broadcast separately. |

| Hot Storage | Private keys stored on internet-connected devices (exchanges, mobile apps, browser extensions). Constant online exposure to attack vectors. |

| Security Model | Cold storage follows zero-trust architecture where keys never touch internet-connected systems. Hot storage requires trust in software security and third-party custodians. |

Hot Wallet vs Cold Wallet: The Critical Differences

Understanding the security, custody, and connectivity differences between hot and cold storage solutions.

| Feature | Hot Wallet | Cold Wallet (Vaultix) |

|---|---|---|

| Network Connection | Always online | Offline / Air-gapped |

| Hack Vulnerability | High risk from remote attacks | Protected by physical isolation |

| Key Custody | Often held by third parties | You control your keys 100% |

| Cloud Dependency | Relies on cloud servers | No cloud, no internet required |

| Malware Risk | Vulnerable to device malware | Immune to software exploits |

| Phishing Protection | Susceptible to phishing | Physical confirmation prevents phishing |

| Exchange Failure Risk | Funds lost if exchange fails | Your keys, your coins always |

| Transaction Speed | Instant signing | Requires physical device confirmation |

| Ideal Use Case | Small amounts, frequent trading | Long-term holdings, large amounts |

| Recovery Method | Platform-dependent | Encrypted seed phrase backup |

| Regulatory Compliance | Subject to KYC/AML tracking | Private, no identity required |

| Multi-Signature Support | Limited availability | Full multi-sig support |

Hot Wallet

Cold Wallet (Vaultix)

🔑 The Fundamental Security Principle

Hot wallets prioritize convenience. Cold wallets prioritize security. For assets you're holding long-term or amounts that would hurt to lose, cold storage is the only responsible choice. MiCA regulations in the EU now treat cold storage as reference architecture for institutional reserve verification, recognizing its superiority for custody security.

The Risks of Exchange Custody

Trusting third parties with your crypto has repeatedly ended in catastrophic losses for investors.

FTX Collapse (2022)

$8 billion in customer funds misappropriated. Users who thought their crypto was safe discovered exchange executives had used deposits for unauthorized trading and loans. Assets frozen overnight with no withdrawal access.

Mt. Gox Hack (2014)

850,000 Bitcoin stolen from the world's largest exchange. Years later, victims still haven't recovered their full holdings. The exchange's hot wallet architecture allowed attackers to drain funds remotely over time.

Custody = No Ownership

When you hold crypto on an exchange, you don't own the keys-you own an IOU. Exchanges can freeze accounts, impose withdrawal limits, or collapse taking your assets with them. Self-custody eliminates counterparty risk entirely.

Regulatory Seizures

Governments can and do freeze exchange assets during investigations. In 2022-2023, multiple exchanges faced seizure orders affecting innocent users' funds. Cold storage keeps your assets beyond reach of third-party control.

Why Institutions Are Moving to Cold Storage

Organizations now treat digital assets as treasury items requiring deterministic control. Institutional clients drive adoption of on-premises key-management appliances, replacing custodial accounts. As of January 2025, providers like Dfns raised $16M to scale wallet-as-a-service for clients including Fidelity International and Zodia Custody, demanding FIPS-certified secure elements and SOC-2 reporting. Cold storage has become the institutional standard for digital asset security.

Software Wallet Vulnerabilities

Hot software wallets on phones and computers face constant attack vectors that cold storage eliminates.

Malware Attacks

Keyloggers and clipboard hijackers can steal private keys or replace wallet addresses. Once malware infects your device, software wallets offer no protection-your keys are exposed to the attacker.

Phishing Schemes

Fake wallet apps, browser extensions, and social engineering tricks users into revealing seed phrases or signing malicious transactions. Software wallets can't distinguish legitimate requests from attacks.

Remote Exploits

Internet-connected devices can be compromised through network vulnerabilities, zero-day exploits, or supply chain attacks. Attackers anywhere in the world can target your software wallet remotely.

Device Compromise

If your phone or computer is stolen, lost, or repaired by untrusted parties, software wallets stored on the device become vulnerable. Physical access often equals key extraction.

Cloud Backup Risks

Many mobile wallets back up encrypted data to iCloud or Google Drive. Cloud providers can be breached, subpoenaed, or suffer data leaks-exposing your encrypted keys to third parties.

Update Vulnerabilities

Software wallet updates can introduce bugs or be hijacked by attackers. Fake updates pushed through compromised channels have tricked users into installing malicious wallet versions.

⚠️ Real-World Software Wallet Losses

- Atomic Wallet hack (2023): Over $35 million stolen from hot wallet users through compromised infrastructure

- Slope wallet breach (2022): $4 million drained from Solana software wallets due to logging vulnerability

- Trust Wallet phishing (2023): Thousands of users tricked by fake browser extensions mimicking popular software wallets

- LastPass breach impact (2022): Encrypted password vaults stolen, exposing crypto seed phrases stored in password managers

Hardware Wallet Benefits: Your Keys, Your Crypto

Cold storage hardware wallets eliminate the attack vectors that compromise software solutions.

Offline Key Storage

Private keys stored in secure element chip, never exposed to internet-connected devices. Air-gapped architecture creates physical isolation from remote attackers and malware.

Physical Transaction Confirmation

Every transaction requires physical button press on device screen showing exact amounts and addresses. Prevents malware from silently changing transaction details or phishing attempts.

Air-Gap Protection

Zero network connectivity eliminates entire classes of attacks. Even if your computer is compromised, attackers cannot remotely access keys stored on offline hardware device.

Secure Element Chip

Military-grade secure element (EAL5+ certified) protects keys from physical tampering, side-channel attacks, and extraction attempts. Keys remain encrypted at hardware level.

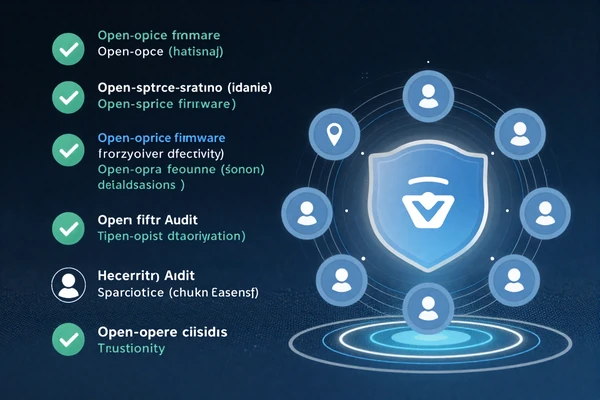

Open-Source Verification

Transparent firmware allows security researchers and community to audit code for backdoors or vulnerabilities. No trust required in manufacturer-verify the code yourself.

True Self-Custody

You control 100% of your private keys with encrypted backup. No third-party custodians, no exchange risk, no counterparty failure scenarios. Your crypto, your responsibility, your ownership.

Why Self-Custody Matters in 2026

The crypto industry's history is littered with exchange failures and custodial disasters. Self-custody isn't just best practice-it's the only way to truly own your digital assets.

The Foundational Principle: "Not Your Keys, Not Your Coins"

This mantra emerged from repeated exchange failures teaching the crypto community a brutal lesson: custodial risk is existential risk. When you hold crypto on an exchange or hot wallet, you own an IOU-a promise that can be broken. Self-custody through cold storage means you possess the cryptographic keys that mathematically prove ownership. No intermediary can freeze, seize, or lose your assets. In an industry built on decentralization and trustlessness, entrusting your wealth to centralized custodians contradicts the core value proposition of cryptocurrency itself.

When Should You Use Cold Storage?

Cold storage is essential for long-term holdings and amounts you can't afford to lose. Here's how to decide.

Portfolio Value Threshold

If you hold more than $1,000 in crypto, cold storage should be your default. The cost of a hardware wallet (~$100-200) is insurance against total loss. For amounts under $500, hot wallets may be acceptable for convenience, but understand you're trading security for ease of access.

Institutional threshold: Any organization managing digital assets should use cold storage with multi-signature controls, regardless of amount.

Holding Period

Long-term holdings (6+ months): Always use cold storage. If you're not actively trading or spending these funds, there's no justification for keeping them on internet-connected systems exposed to daily attack vectors.

Short-term trading: Keep only the minimum amount needed on exchanges or hot wallets for active trading. Transfer profits to cold storage regularly.

Asset Type Considerations

Store in cold storage: Bitcoin and major cryptocurrencies you're holding for appreciation, NFTs with significant value, staking rewards accumulation, inheritance assets, business treasury reserves.

Hot wallet acceptable: Small amounts for daily spending, gas fees for transactions, DeFi positions you're actively managing, tokens with minimal value.

Risk Tolerance Assessment

Ask yourself: "If this amount disappeared tomorrow due to an exchange hack or wallet breach, would it significantly impact my finances?" If yes, use cold storage.

Security-first approach: Assume all hot wallets and exchanges will eventually be compromised. Cold storage is the only model where security doesn't depend on third-party competence.

🎯 Vaultix Recommendation

Follow the 80/20 rule: Keep 80% of your crypto portfolio in cold storage (Vaultix or similar hardware wallet), and maximum 20% on exchanges or hot wallets for active use. Transfer gains to cold storage regularly. For amounts over $50,000, consider multi-signature cold storage setup for additional protection against single points of failure.

How Cold Storage Protects Against Common Attacks

Understanding specific attack vectors and how hardware wallets neutralize each threat.

🎣 Attack: Phishing & Social Engineering

Hot Wallet Vulnerability:

- Fake wallet apps and browser extensions trick users into entering seed phrases

- Malicious transaction approval requests hidden in legitimate-looking interfaces

- No physical confirmation-software can silently change recipient addresses

🛡️ Cold Storage Defense

Vaultix Protection:

- Physical device screen shows exact transaction details before signing

- Manual button confirmation required-malware cannot auto-approve transactions

- Seed phrase generated and stored on device, never entered online

🦠 Attack: Malware & Keyloggers

Hot Wallet Vulnerability:

- Keyloggers capture seed phrases and passwords as you type them

- Clipboard hijackers replace wallet addresses with attacker's addresses

- Private keys stored in software memory can be extracted by malware

🛡️ Cold Storage Defense

Vaultix Protection:

- Private keys never leave secure element chip-no exposure to infected computers

- Air-gapped design means malware on your PC cannot access wallet keys remotely

- Transaction signing happens offline on device, then broadcast separately

🌐 Attack: Remote Network Exploits

Hot Wallet Vulnerability:

- Zero-day exploits in mobile OS or wallet apps allow remote key extraction

- Network man-in-the-middle attacks can intercept transaction data

- Cloud backup vulnerabilities expose encrypted wallet files to attackers

🛡️ Cold Storage Defense

Vaultix Protection:

- Zero network connectivity-no WiFi, Bluetooth, or cellular interfaces to exploit

- Physical USB-only connection for transaction broadcast, keys stay on device

- No cloud backups-recovery seed encrypted offline under your control

📱 Attack: Device Theft or Loss

Hot Wallet Vulnerability:

- Stolen phones often have wallet apps with inadequate PIN protection

- Device repair shops can access unencrypted wallet data during service

- Physical access to device often allows brute-force attacks on app passwords

🛡️ Cold Storage Defense

Vaultix Protection:

- PIN-protected device with limited attempts before auto-wipe

- Secure element chip resists physical tampering and side-channel attacks

- Recovery seed stored separately allows fund restoration even if device lost

🎭 Attack: Supply Chain Compromise

Hot Wallet Vulnerability:

- Fake wallet apps in app stores look identical to legitimate versions

- Software updates can be hijacked to inject malicious code

- No way to verify closed-source wallet app integrity before installation

🛡️ Cold Storage Defense

Vaultix Protection:

- Open-source firmware allows community security audits and verification

- Cryptographically signed firmware updates prevent unauthorized modifications

- Supply chain security with tamper-evident packaging and verification process

Institutional Cold Storage Requirements

Organizations managing digital assets face heightened security, compliance, and audit requirements that make cold storage essential.

Why Institutions Choose Cold Storage

As of 2026, institutional clients treat digital assets as treasury items requiring deterministic control. The shift from custodial accounts to on-premises key-management appliances reflects lessons learned from exchange failures like FTX. Providers like Dfns (USD 16M funding January 2025) serve clients including Fidelity International and Zodia Custody with FIPS-certified secure elements and SOC-2 reporting.

Institutional-Grade Requirements:

- Multi-Signature Controls: Require multiple authorized signers to approve transactions, preventing single points of failure

- Hardware Security Modules (HSM): FIPS 140-2 Level 3+ certified secure elements for key storage and signing operations

- Audit Trail & Compliance: Complete transaction logging, SOC-2 Type II reporting, regulatory compliance for MiCA/OCC custody rules

- Disaster Recovery: Geographic distribution of key shards, time-locked recovery mechanisms, inheritance protocols

- Supply Chain Verification: Tamper-evident packaging, firmware attestation, secure boot chain validation

- Insurance Requirements: Many crypto custody insurance policies mandate cold storage with specific security controls

Regulatory Recognition of Cold Storage

European Union's MiCA (Markets in Crypto-Assets) regulations treat cold storage as reference architecture for institutional reserve verification. The U.S. Office of the Comptroller of the Currency (OCC) published guidance in 2020 recognizing qualified custodians must demonstrate robust key management, implicitly favoring cold storage models.

For DAOs and treasuries: Cold storage with multi-signature controls has become the governance standard for on-chain organizations managing significant assets. Platforms like Gnosis Safe integrate with hardware wallets to enable secure multi-sig treasury management.

Secure Your Assets with Vaultix Cold Storage

Join the waitlist for early access to the next generation of hardware wallet security. Reserve your spot in the first production batch shipping Q3/Q4 2026.

No payment required. Cancel anytime. Early access pricing for first batch.