Built for Every Crypto User: Your Use Case, Our Solution

From individual HODLers to institutional treasuries, Vaultix provides hardware cold storage tailored to your security needs. Five primary use cases, one comprehensive solution.

Who Vaultix Protects

Vaultix identifies five primary user segments spanning retail to institutional applications. Each segment has unique security requirements and workflow needs that our hardware wallet addresses.

Long-Term Holders

HODLers securing large cryptocurrency positions for years, requiring maximum security for assets worth $50K to millions. Air-gapped protection against remote attacks.

DeFi Protocol Users

Active traders and liquidity providers requiring secure transaction signing for smart contract interactions on Ethereum, Solana, and other DeFi protocols.

NFT Collectors

Digital art and collectible owners storing high-value NFTs worth thousands to millions. Multi-chain support for Ethereum, Polygon, Solana NFT ecosystems.

DAO Treasuries

Decentralized organizations managing community funds through multi-signature workflows. Audit trails, governance integration, and organizational asset management.

Business Reserves

Corporations holding cryptocurrency as treasury assets or for operational use. Compliance-ready with FIPS-certified secure elements and SOC-2 audit capabilities.

Long-Term Holders (HODLers): Secure Large Positions

The HODLer Persona

Long-term cryptocurrency holders-often called HODLers-acquired digital assets during early adoption phases or through consistent accumulation strategies. These individuals view Bitcoin, Ethereum, and other cryptocurrencies as long-term stores of value, holding positions for years rather than trading actively.

Typical profile: Portfolio values ranging from $50,000 to several million dollars, accumulated over 3-10 years. Primary concern is protecting wealth from exchange hacks, custodial failures, and remote attacks. They prioritize security over convenience and are willing to manage seed phrases carefully.

Pain points addressed:

- Fear of exchange collapse (post-FTX trauma)

- Anxiety about custodial third-party risks

- Concern about software wallet vulnerabilities

- Need for inheritance planning and recovery options

Example Portfolio Allocation

Total Portfolio: $485,000

├─ Bitcoin (BTC): $275,000 (56.7%)

├─ Ethereum (ETH): $145,000 (29.9%)

├─ Solana (SOL): $35,000 (7.2%)

├─ Other Altcoins: $25,000 (5.2%)

└─ Stablecoins (USDC): $5,000 (1.0%)

Storage Strategy: 100% cold storage on Vaultix

Backup: Encrypted seed phrase in fireproof safe

Recovery Plan: Multi-location backup distributionTypical allocation for a 7-year Bitcoin accumulator with diversified holdings. All assets stored offline to eliminate custodial risk.

Why Vaultix for Long-Term Holdings

Air-Gapped Security

Keys never touch internet-connected devices. Complete isolation from remote attacks, malware, and phishing.

Encrypted Recovery

Seed phrase backup system with optional passphrase protection. Inheritance planning support for estate transfer.

Long-Term Durability

Industrial-grade materials and secure element chip designed for 10+ year lifespan. Firmware updates for future compatibility.

DeFi Users: Secure Protocol Interactions

The DeFi User Persona

Decentralized finance (DeFi) users actively interact with smart contracts on Ethereum, Solana, Avalanche, and other blockchain networks. They provide liquidity, trade on decentralized exchanges, participate in lending protocols, and manage yield farming strategies.

Typical profile: Tech-savvy users managing $10,000 to $500,000+ across multiple DeFi protocols. Daily or weekly transaction activity requiring secure signing without compromising on usability. Understand smart contract risks and prioritize transaction verification.

DeFi activities requiring secure signing:

- Liquidity provision on Uniswap, Curve, Balancer

- Lending and borrowing via Aave, Compound, MakerDAO

- Staking and yield farming across protocols

- NFT marketplace transactions (OpenSea, Blur, Magic Eden)

- DAO governance voting and proposal submission

Offline Transaction Signing Workflow

Initiate Transaction

DeFi application creates unsigned transaction data on desktop or mobile app (e.g., "Swap 2 ETH for USDC on Uniswap").

Transfer to Vaultix

Transaction details transferred to Vaultix via USB or QR code. Device remains air-gapped from network.

Verify & Sign Offline

Vaultix display shows contract address, function call, gas fees. User physically confirms on device. Private key signs transaction internally-keys never leave secure element.

Broadcast Signed Transaction

Signed transaction returned to application and broadcast to blockchain. Vaultix never connects to internet.

Supported DeFi Protocols (Launch Compatibility)

Decentralized Exchanges

- Uniswap (Ethereum, Polygon)

- Curve Finance

- Raydium (Solana)

- Jupiter (Solana)

Lending Protocols

- Aave (multiple chains)

- Compound Finance

- MakerDAO

- Solend (Solana)

Liquid Staking

- Lido Finance

- Rocket Pool

- Marinade Finance (Solana)

- Frax Finance

Vaultix integrates with Ethereum, Solana, Polygon, Avalanche, and other EVM-compatible chains. Desktop and mobile companion apps provide DeFi dApp connectivity.

NFT Collectors: Vault Storage for Valuable Digital Art

The NFT Collector Persona

NFT collectors own digital art, collectibles, gaming assets, and tokenized real-world assets with values ranging from hundreds to millions of dollars per piece. High-profile NFT thefts via phishing and wallet exploits have made hardware cold storage essential for serious collectors.

Typical profile: Owns 10-500+ NFTs across Ethereum, Solana, Polygon, and other chains. Portfolio includes blue-chip collections (Bored Ape Yacht Club, CryptoPunks, Art Blocks), emerging artists, and gaming assets. Primary concern is preventing theft via social engineering or malicious smart contract approvals.

Security threats NFT collectors face:

- Phishing websites mimicking OpenSea, Blur, Magic Eden

- Malicious smart contract approvals granting unlimited access

- Discord/Twitter social engineering attacks

- Compromised hot wallets on exchange platforms

- Insider threats from marketplace vulnerabilities

How Vaultix Protects NFT Collections

Multi-Chain NFT Support

Compatible with Ethereum ERC-721/ERC-1155, Solana NFTs, Polygon, and other major chains. View collection metadata via companion app.

Transaction Verification

On-device display shows exact NFT contract address, token ID, and recipient before signing. Prevent approval scams.

Vault Mode

Optional "vault mode" requires physical device confirmation for any NFT transfer, even with seed phrase compromise protection.

Example NFT Collection Secured by Vaultix

Total Collection Value: $287,000

├─ Ethereum NFTs

│ ├─ Art Blocks Curated (3 pieces): $85,000

│ ├─ Azuki (2 NFTs): $45,000

│ ├─ Pudgy Penguins (1 NFT): $32,000

│ └─ Emerging Artists (12 pieces): $18,000

├─ Solana NFTs

│ ├─ Mad Lads (4 NFTs): $52,000

│ ├─ DeGods (2 NFTs): $38,000

│ └─ Solana Monkey Business (1 NFT): $12,000

└─ Gaming Assets (Polygon)

└─ Axie Infinity, Gods Unchained: $5,000

Storage: 100% cold storage on Vaultix

Access: View-only wallet for browsing, signing only via deviceTypical portfolio for a 2-year NFT collector focusing on blue-chip and generative art. All transfers require physical Vaultix confirmation.

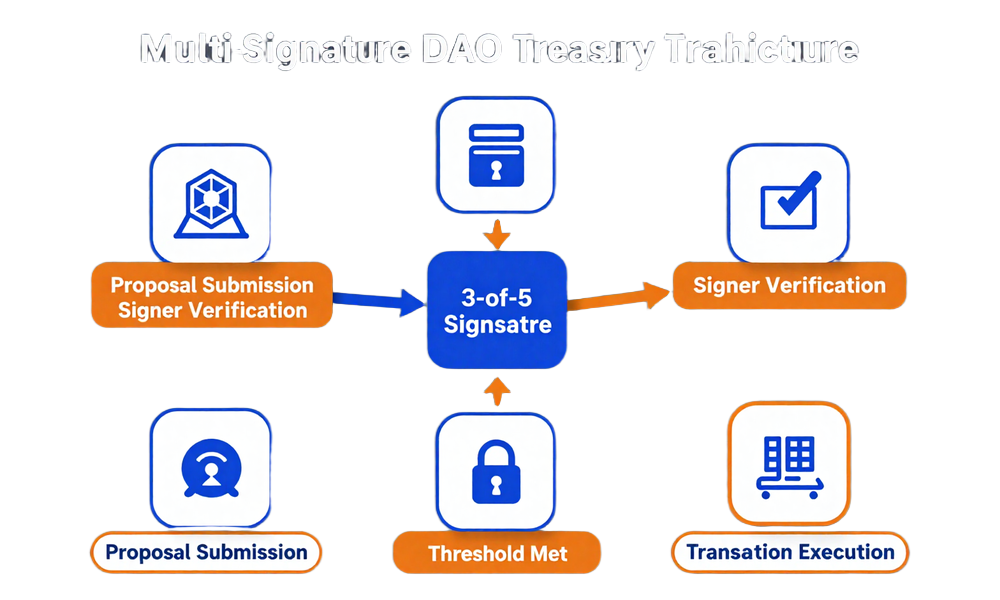

DAO Treasuries: Multi-Sig Organizational Asset Management

The DAO Treasury Persona

Decentralized Autonomous Organizations (DAOs) manage community funds ranging from hundreds of thousands to billions of dollars. Treasury management requires multi-signature workflows, audit trails, and governance integration-making hardware wallets essential for institutional-grade security.

Typical profile: DAO managing $500K to $100M+ in treasury assets across stablecoins, governance tokens, and diversified crypto holdings. Treasury signers include 3-15 trusted community members requiring coordination for fund movements. Compliance and transparency are critical for community trust.

DAO treasury requirements:

- Multi-signature (multi-sig) wallet support (e.g., Gnosis Safe, Squads Protocol)

- Audit trail for all treasury transactions with signer attribution

- Governance integration for community proposal execution

- Hardware security for each individual signer

- Compliance-ready reporting for regulatory scrutiny

Multi-Signature Architecture with Vaultix

Example 3-of-5 multi-sig setup: Any treasury transaction requires approval from at least 3 out of 5 designated Vaultix signers. Each signer verifies transaction details on their hardware device before signing offline.

Enterprise Features for DAO Treasuries

Multi-Sig Integration

Native support for Gnosis Safe (Ethereum/Polygon), Squads Protocol (Solana), and other multi-signature wallet standards. Bulk device provisioning for treasury signers.

Audit Trail & Reporting

Transaction history with signer attribution for transparency. Export compliance reports for regulatory scrutiny and community accountability.

Governance Integration

Sign governance proposals, execute on-chain votes, and manage DAO operations directly from hardware wallet. Snapshot and Tally integration.

Example DAO Treasury Configuration

DAO Name: DeFi Innovation Fund

Treasury Size: $12.5 Million

Multi-Sig Setup: 4-of-7 threshold (Gnosis Safe on Ethereum)

Treasury Composition:

├─ Stablecoins (USDC, DAI): $6.2M (49.6%)

├─ Governance Token (DIF): $3.8M (30.4%)

├─ Ethereum (ETH): $1.5M (12.0%)

├─ Strategic Investments: $800K (6.4%)

└─ Operating Reserve (USDT): $200K (1.6%)

Vaultix Signer Distribution:

- 7 elected community members each hold Vaultix device

- 4 signatures required for any treasury transaction

- Proposal voting via Snapshot, execution via Vaultix signing

- Monthly compliance audit exports for community transparencyTypical mid-size DAO treasury structure with institutional security standards. Vaultix provides hardware security for each individual signer in the multi-sig configuration.

Business Reserves: Corporate Cryptocurrency Holdings

The Corporate Treasury Persona

Corporations increasingly hold cryptocurrency as treasury assets or for operational purposes. According to institutional research, organizations now treat digital assets as treasury items requiring deterministic control. The enterprise crypto custody market is projected to triple over the next four years as traditional financial institutions increase digital asset allocations.

Typical profile: Technology companies, payment processors, fintech startups, and forward-thinking enterprises holding $100K to $100M+ in cryptocurrency reserves. CFOs and treasury managers demand bank-grade security, compliance-ready audit trails, and SOC-2/ISO-certified solutions.

Corporate cryptocurrency use cases:

- Bitcoin/Ethereum as treasury reserve assets (following MicroStrategy, Tesla precedent)

- Stablecoin holdings for international payment settlement

- Crypto payroll for distributed remote teams

- Web3 company operational funds (gas fees, smart contract deployment)

- Cross-border B2B payment rails via USDC/USDT

Enterprise Compliance & Security Standards

Corporate cryptocurrency custody demands exceed retail security requirements. Vaultix enterprise features address regulatory, accounting, and internal control standards:

✅ FIPS 140-2 Certification

Secure element chip meets Federal Information Processing Standards for cryptographic modules. Required for financial institutions and government contractors.

✅ SOC 2 Type II Audit

Annual third-party audits of security, availability, and confidentiality controls. Provides assurance for enterprise procurement and risk management teams.

✅ Multi-Device Management

Centralized provisioning and policy enforcement for 10-1,000+ Vaultix devices. Role-based access control (RBAC) for different authorization levels (CFO, treasurer, accountant).

✅ Accounting Integration

Export transaction history for GAAP/IFRS financial reporting. Integration with Ledgible, CoinTracker, and enterprise ERP systems for cryptocurrency accounting.

✅ Insurance Compatibility

Documentation and security attestations required by crypto custody insurance providers (e.g., Evertas, Marsh, Lloyd's of London syndicates).

✅ Regulatory Reporting

Audit trail exports for IRS Form 8300, FinCEN reporting, and international regulatory compliance (MiCA in EU, VASP regulations globally).

Example Corporate Treasury Configuration

Company: TechFlow Payments (B2B Payment Processor)

Cryptocurrency Treasury: $8.3 Million

Vaultix Deployment: 5 hardware devices (multi-sig 3-of-5)

Reserve Allocation:

├─ Bitcoin (BTC) - Long-term hold: $3.5M (42.2%)

├─ USDC - Payment settlement float: $2.8M (33.7%)

├─ Ethereum (ETH) - Gas reserves: $1.2M (14.5%)

├─ USDT - International B2B: $600K (7.2%)

└─ Operating expenses (mixed): $200K (2.4%)

Custody Configuration:

- CFO holds primary Vaultix device

- Treasurer and VP Finance hold backup devices

- External auditor and board member hold emergency recovery devices

- 3-of-5 multi-sig required for any transaction >$50K

- Monthly SOC 2 compliance reporting to board

- Quarterly third-party security audits

Accounting Integration:

- Ledgible for tax reporting and cost-basis tracking

- NetSuite ERP integration for balance sheet reporting

- Real-time mark-to-market valuation for GAAP complianceTypical fintech company treasury structure holding cryptocurrency for both investment and operational purposes. Vaultix enterprise deployment with compliance-ready controls.

Retail vs Enterprise Applications

Vaultix serves both individual users and institutional organizations with scalable security features. While core cryptographic security is identical, enterprise deployments add compliance, management, and reporting capabilities.

| Feature | Retail (Individual) | Enterprise (Organization) |

|---|---|---|

| Target User | HODLers, DeFi users, NFT collectors | DAO treasuries, corporate reserves |

| Portfolio Size | $10K - $5M typical | $500K - $100M+ typical |

| Device Quantity | 1-2 devices per user | 5-1,000+ devices per organization |

| Multi-Sig Support | ✓ | ✓ |

| FIPS Certification | ✗ | ✓ |

| SOC 2 Compliance | ✗ | ✓ |

| Centralized Management | ✗ | ✓ |

| Accounting Integration | Basic export | Full ERP integration |

| Insurance Compatibility | Personal coverage | Institutional custody insurance |

| Priority Support | 48-hour response | Dedicated account manager |

| Bulk Provisioning | ✗ | ✓ |

| Custom Firmware | ✗ | Available for enterprise |

Retail (Individual)

Enterprise (Organization)

Both retail and enterprise users benefit from the same secure element chip, open-source firmware, and air-gapped transaction signing. Enterprise features add organizational controls without compromising core security.

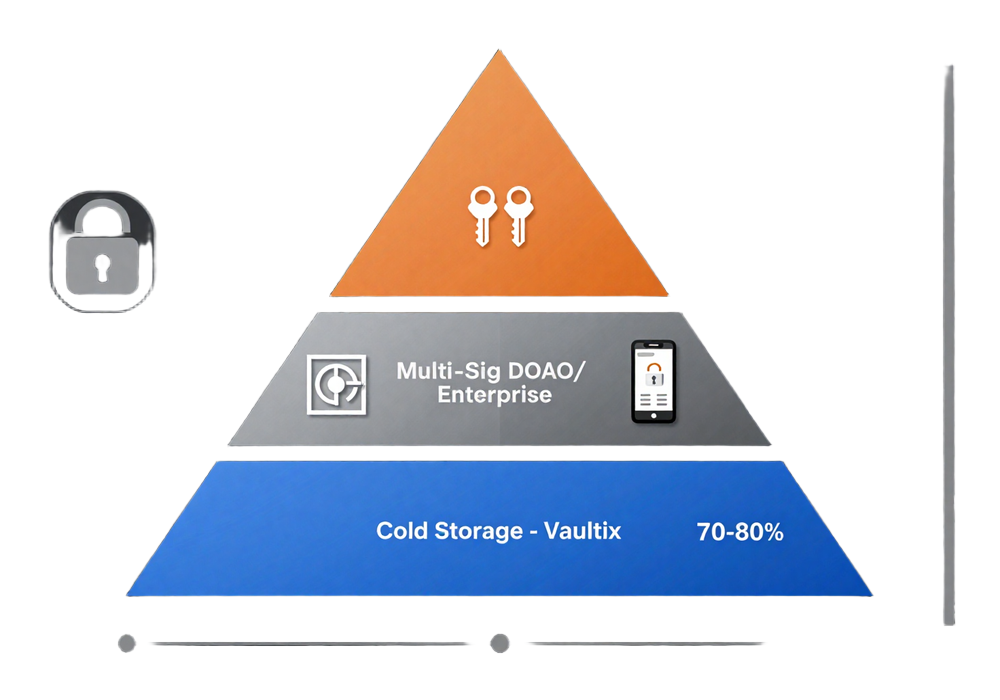

Portfolio Security Strategy: Diversification Across Cold Storage

Security-conscious cryptocurrency holders implement tiered storage strategies, allocating assets across hot wallets, hardware cold storage, and multi-sig solutions based on risk tolerance and access frequency.

Recommended Allocation Framework

🔒 Cold Storage Vault (70-80%)

Storage: Vaultix hardware wallet, offline seed phrase backup

Assets: Long-term Bitcoin/Ethereum holdings, blue-chip NFTs, retirement-tier investments

Access: Quarterly or annual rebalancing only. Maximum security, minimum access frequency.

Security Level: Maximum

🛡️ Multi-Sig Intermediate (10-20%)

Storage: Gnosis Safe or Squads multi-sig with 2-3 Vaultix signers

Assets: Active DeFi positions, DAO governance holdings, business operational funds

Access: Weekly to monthly transactions. Balanced security and accessibility.

Security Level: High

⚡ Hot Wallet Active (5-10%)

Storage: MetaMask, Phantom, or mobile wallet for daily use

Assets: Gas fee reserves, active trading capital, small NFT purchases

Access: Daily transactions. Convenience prioritized, acceptable risk exposure limited by small allocation.

Security Level: Standard

🎯 Portfolio Allocation Example: $500K Total Holdings

Total Portfolio: $500,000

TIER 1: Cold Storage - Vaultix (75% = $375,000)

├─ Bitcoin long-term hold: $200,000

├─ Ethereum long-term hold: $120,000

├─ Blue-chip NFT collection: $35,000

└─ Altcoin strategic positions: $20,000

Access: Stored offline, touched 1-2x per year

TIER 2: Multi-Sig Intermediate (15% = $75,000)

├─ Aave lending position (USDC): $40,000

├─ Uniswap liquidity provision: $25,000

└─ DAO governance tokens: $10,000

Access: Gnosis Safe 2-of-3 multi-sig, weekly activity

TIER 3: Hot Wallet Active (10% = $50,000)

├─ Trading capital on DEXes: $30,000

├─ Gas reserves (ETH, SOL): $15,000

└─ NFT marketplace purchases: $5,000

Access: MetaMask/Phantom, daily transactions

Risk Management: Even if hot wallet compromised, 90% of portfolio remains secure in cold storage and multi-sig. Tiered approach balances security with usability.Find Your Use Case - Join the Vaultix Waitlist

Whether you're a long-term HODLer, active DeFi user, NFT collector, DAO treasurer, or corporate CFO-Vaultix provides hardware cold storage tailored to your security requirements. Join 10,000+ users on the pre-order waitlist for early access and exclusive launch pricing.

Reserve Your Vaultix WalletNo payment required. Early access reservation only. Shipping Q3/Q4 2026.